SKYNET USA ASSET MANAGEMENT & CONSULTING, INC.

CREDIT CONSULTING DIVISION

Excellent Credit Gets You the Best Personal Credit Card

&

Corporate Credit Card Offers

FICO SCORE 680+

CREDIT CONSULTING DIVISION

Excellent Credit Gets You the Best Personal Credit Card

&

Corporate Credit Card Offers

FICO SCORE 680+

PERSONAL LOANS FICO 680+

Requirements: FICO Score 680 + 6 Trade Lines

Apply for from $5,000 to $100,000, with no collateral required and receive a no obligation loan decision.

Personal Loans are loans provided by independent lenders directly to a borrower.

Customer Notice: Personal Loans online should only be used when and if you can afford them. Customers with credit difficulties should seek credit counseling.

Skynet online provides online loan services of one type or another in almost all 50 states. However, some states only allow for issuing installment loans or lines of credit.

Skynet online lenders act as a credit service organization or credit access businesses (CSO/CAB) in Texas and are not the lender - loans there are made by third-party lenders in accordance with Texas Law.

This is an invitation to submit a loan application, not an offer to make a loan. No person applying is guaranteed to receive either a personal loan, installment loan or line of credit loan.

Skynet Loans is an online service that only provides access to lenders that have been predetermined as providing safe personal loans directly to consumers. You can apply right here online. We collect information about your bank account details, as well as employment details, and we keep all data confidential. We only use it to process your online personal loan application. Your information is always kept safe and secure when you apply online through Skynet Loans.

Through encryption and high levels of data security, we protect you and we keep your information safe. Our systems have been developed to guard against identity theft. We understand how valuable your personal details are: your social security number, bank account number, address and phone numbers, etc.

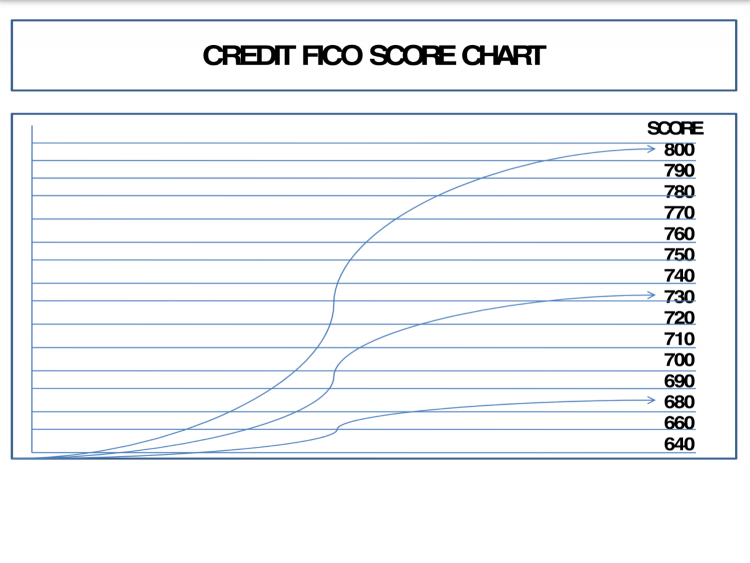

Credit Score Range

Each of the three credit bureaus have different credit score ranges – or at least one of them is different from the rest:

TransUnion: 300-850

Equifax: 300-850

Experian: 340-820

Each of these bureaus have different methods in calculating the scores they release. Because of this, it is possible for you to have varying scores when you get from all three at the same time. We do have reports that they are working on coming up with a standard way of computing things. In the meantime, a lot of lenders use the FICO score as basis for your loan approval – or whatever is applicable.

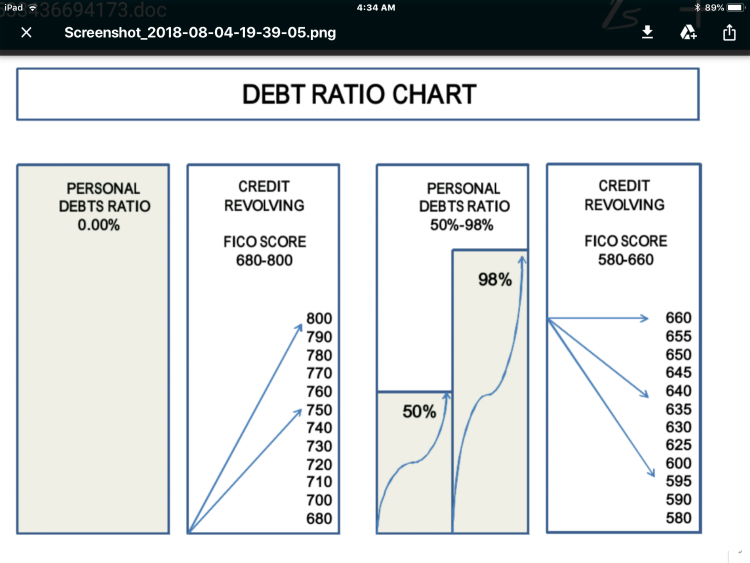

So what is considered to be a good or bad score?

Different sources will tell you various ranges to determine what a good credit score is or not. A good score for an auto loan may not be the same as a mortgage loan. Although, a score of 660, in general, is considered to be a score. 620 is perceived to be a bad score. Anything in between is not really bad but it does leave room for improvement. For a detailed description, here is a breakdown:

720-850: No risk borrower – This is the best score that you can possibly have. This means you are in great shape and can get the best deals out of any finance related transaction.

675-719: Very Low risk borrower – This is still a good score and can get you a good interest rate on any loan.

675-699: Low risk borrower – This range will still get you good deals from most loans.

620-674: Moderate risk borrower – While considered to be a good range this score will already get you a higher interest rate from some lenders.

560-619: High risk borrower – Qualification for a loan will already be difficult and you need to improve on your score – otherwise, you may suffer high interest rates on your loans.

500-559: Very High risk borrower – You need to improve your score before attempting to apply for a loan – otherwise you will either be turned away or given a very high interest rate for being a high risk borrower.

Bottom line of these ranges is to indicate to the lender your risk factor as a borrower. The lower the score, the higher your risk and the higher your interest rate will be. So if you want to take out a major loan in the future, you have to keep your credit score 720 or above.

What is a Credit Score?

his score is computed based on the credit report that the three major credit bureaus (Equifax, TransUnion and Experian) have gathered about you. They gather your data from banks and other financial institutions that you have dealt with. Your credit history will affect how your credit score will come out. It is computed through a special formula that grades 5 different points of your credit history.

A credit score is the numerical value that will measure your creditworthiness. It indicates how you handle your finances, your ability to pay off a debt and your payment behavior. Lenders need all of this information to determine if you are a high risk borrower or not. The lower your score is, the higher you are graded as an investment risk. If you are found to be very risky, they will have to take steps in order to protect their investment. The credit score looks at both the positive and negative aspects of your credit data. Even if you have a lot of debts, it is possible for you to have a high score – at least if you are good and diligent with your payments. Also, if you have no credit cards or accounts (thus you have no debts), you will most likely have a low score. This is because there is no data supporting how well you can pay a debt or not – thus making you a high risk borrower.

Payment History

The first and the most influential is your payment history. It constitutes 35% of your credit score. It will look into your behavior in paying for credit cards, mortgage loans and other installment accounts. This also includes your retail accounts – if any.

A late payment or two will not drag your score down – even if it is the most recent payments. It will take into account your payment behavior as a whole. Negative factors that can have drastic effects on this figure includes lawsuits, bankruptcies and foreclosures.

It may be important to note that this considers the number of accounts that you have no late payments. So if you were delinquent in only one account and good in the others, your score will not be too low.

Debts

The next factor affecting your credit score is the total amount of debt that you have. This credit score factor comes in at 30% of your score. The thing is, even if you have a lot of debts with other lenders, that does not automatically make you a high risk borrower. This system takes into account your ability to pay off your debts. As long are your credit cards are not maxed out or overtaken by the amount of what you owe, then your credit score should be in good shape.

The software examines not only the total amount of debt but the amount for each type of account (e.g. credit card, loan, etc). It also determines the number of accounts with low balances and those who have been paid completely.

Credit History

The rule for this factor is, the longer you have an account, the better it is for your score. This amounts to 15% of your overall credit score.

Bottom line is, age matters. It counts the number of accounts that you have, how long you have had them under your name and the average age that your accounts have been active.

Your score will also be affected by how often you use certain accounts like your credit cards. If they show that you use it often and yet your balance is low, then that will reflect a high score. On the other hand, if you are not using your card much and yet you have a high balance, then that does not bode well for you.

How to Get Pre-Approved or Pre-Qualify for a Credit Card

A credit card can come in handy in many different ways. If you want to enjoy a life of maximum convenience, credit card approval can go a long way. It can give you access to a broad assortment of advantages as well. These include the opportunity to enhance your credit score, freedom to not carry around cash and large assortment of rewards possibilities.

It doesn’t matter if you like the idea of not having to have cash on hand at all times. It doesn’t matter if you want to be able to earn miles that can go toward upcoming air travel. Credit cards can be a source of pure convenience and ease for many. If you want to know how to get credit card pre-approval, there are various suggestions that can help you go on the right path. It isn’t impossible to get a credit card. It’s even often possible if you have bad credit, perhaps surprisingly enough.

Know That Application Moderation Is Key

Don’t make the mistake of filling out applications for excessive numbers of cards all at the same time. It’s critical to understand that the application process dings your score. People who try to sign up for multiple cards simultaneously, as a result, don’t leave potential lenders with positive first impressions.

Understand that time is your friend. There’s nothing wrong with taking things slowly but surely with the application process. Aim to split up your applications by a minimum of six months if at all possible.

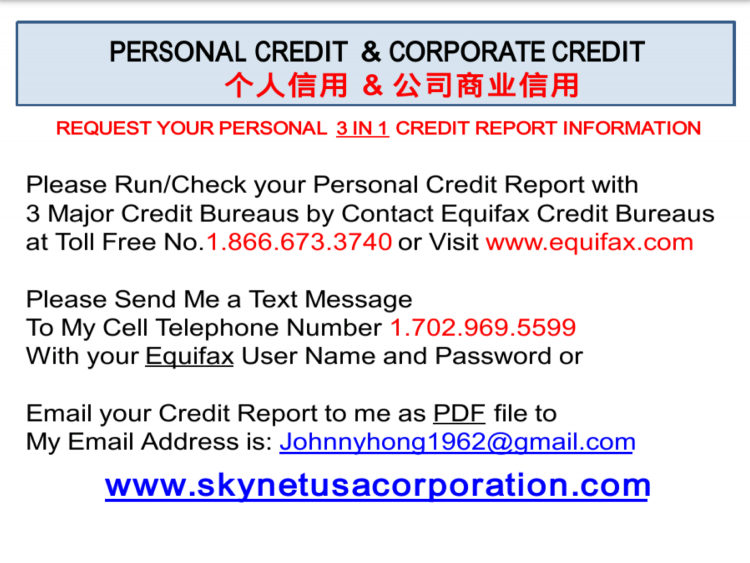

Be Aware of the Information in Your Credit Reports

It’s vital to critically assess the information that’s in your credit reports prior to applying for any cards. If you’re in the loop, you can catch and manage possible mistakes. It can be a recipe for disaster to apply for a card prior to checking your report for possible issues and inconsistencies. You don’t want laziness to interfere with your chances of securing a helpful credit card, after all. If you analyze your credit report and pick up on any mistakes, you need to reach out to your credit reporting firm as soon as possible. Dispute filing can often quickly turn things around.

Be Responsible For Bill Payment

Responsibility is key for people who want to be able to secure the cards of their dreams. If you want potential lenders to be 100 percent aware of the fact that they can trust you, you need to prove to them that you’re responsible and dependable. Make a point to take care of all of your bills in a prompt and punctual manner. Steer clear of paying your bills late. You have to pay bills for your utilities, rent, mortgage, student loans and credit cards by their due dates, no exceptions. If you want to get pre-approved without hassle, you can’t be careless about your energy bills. You can’t be casual about anything bill-related for that matter.

Understand That There Are Cards That Are Appropriate For Your Specific Score Don’t waste your precious time. It can be a pointless to fill out applications for credit cards that cater to people that have scores that are either higher or lower than yours. If your credit score is just “so-so,” don’t try to sign up for a card that’s suitable for people who have exemplary ratings. Your chances of getting pre-approved are practically nonexistent. If you want to be wise and efficient, begin with cards that are appropriate for your score range.

Requirements: FICO Score 680 + 6 Trade Lines

Apply for from $5,000 to $100,000, with no collateral required and receive a no obligation loan decision.

Personal Loans are loans provided by independent lenders directly to a borrower.

Customer Notice: Personal Loans online should only be used when and if you can afford them. Customers with credit difficulties should seek credit counseling.

Skynet online provides online loan services of one type or another in almost all 50 states. However, some states only allow for issuing installment loans or lines of credit.

Skynet online lenders act as a credit service organization or credit access businesses (CSO/CAB) in Texas and are not the lender - loans there are made by third-party lenders in accordance with Texas Law.

This is an invitation to submit a loan application, not an offer to make a loan. No person applying is guaranteed to receive either a personal loan, installment loan or line of credit loan.

Skynet Loans is an online service that only provides access to lenders that have been predetermined as providing safe personal loans directly to consumers. You can apply right here online. We collect information about your bank account details, as well as employment details, and we keep all data confidential. We only use it to process your online personal loan application. Your information is always kept safe and secure when you apply online through Skynet Loans.

Through encryption and high levels of data security, we protect you and we keep your information safe. Our systems have been developed to guard against identity theft. We understand how valuable your personal details are: your social security number, bank account number, address and phone numbers, etc.

Credit Score Range

Each of the three credit bureaus have different credit score ranges – or at least one of them is different from the rest:

TransUnion: 300-850

Equifax: 300-850

Experian: 340-820

Each of these bureaus have different methods in calculating the scores they release. Because of this, it is possible for you to have varying scores when you get from all three at the same time. We do have reports that they are working on coming up with a standard way of computing things. In the meantime, a lot of lenders use the FICO score as basis for your loan approval – or whatever is applicable.

So what is considered to be a good or bad score?

Different sources will tell you various ranges to determine what a good credit score is or not. A good score for an auto loan may not be the same as a mortgage loan. Although, a score of 660, in general, is considered to be a score. 620 is perceived to be a bad score. Anything in between is not really bad but it does leave room for improvement. For a detailed description, here is a breakdown:

720-850: No risk borrower – This is the best score that you can possibly have. This means you are in great shape and can get the best deals out of any finance related transaction.

675-719: Very Low risk borrower – This is still a good score and can get you a good interest rate on any loan.

675-699: Low risk borrower – This range will still get you good deals from most loans.

620-674: Moderate risk borrower – While considered to be a good range this score will already get you a higher interest rate from some lenders.

560-619: High risk borrower – Qualification for a loan will already be difficult and you need to improve on your score – otherwise, you may suffer high interest rates on your loans.

500-559: Very High risk borrower – You need to improve your score before attempting to apply for a loan – otherwise you will either be turned away or given a very high interest rate for being a high risk borrower.

Bottom line of these ranges is to indicate to the lender your risk factor as a borrower. The lower the score, the higher your risk and the higher your interest rate will be. So if you want to take out a major loan in the future, you have to keep your credit score 720 or above.

What is a Credit Score?

his score is computed based on the credit report that the three major credit bureaus (Equifax, TransUnion and Experian) have gathered about you. They gather your data from banks and other financial institutions that you have dealt with. Your credit history will affect how your credit score will come out. It is computed through a special formula that grades 5 different points of your credit history.

A credit score is the numerical value that will measure your creditworthiness. It indicates how you handle your finances, your ability to pay off a debt and your payment behavior. Lenders need all of this information to determine if you are a high risk borrower or not. The lower your score is, the higher you are graded as an investment risk. If you are found to be very risky, they will have to take steps in order to protect their investment. The credit score looks at both the positive and negative aspects of your credit data. Even if you have a lot of debts, it is possible for you to have a high score – at least if you are good and diligent with your payments. Also, if you have no credit cards or accounts (thus you have no debts), you will most likely have a low score. This is because there is no data supporting how well you can pay a debt or not – thus making you a high risk borrower.

Payment History

The first and the most influential is your payment history. It constitutes 35% of your credit score. It will look into your behavior in paying for credit cards, mortgage loans and other installment accounts. This also includes your retail accounts – if any.

A late payment or two will not drag your score down – even if it is the most recent payments. It will take into account your payment behavior as a whole. Negative factors that can have drastic effects on this figure includes lawsuits, bankruptcies and foreclosures.

It may be important to note that this considers the number of accounts that you have no late payments. So if you were delinquent in only one account and good in the others, your score will not be too low.

Debts

The next factor affecting your credit score is the total amount of debt that you have. This credit score factor comes in at 30% of your score. The thing is, even if you have a lot of debts with other lenders, that does not automatically make you a high risk borrower. This system takes into account your ability to pay off your debts. As long are your credit cards are not maxed out or overtaken by the amount of what you owe, then your credit score should be in good shape.

The software examines not only the total amount of debt but the amount for each type of account (e.g. credit card, loan, etc). It also determines the number of accounts with low balances and those who have been paid completely.

Credit History

The rule for this factor is, the longer you have an account, the better it is for your score. This amounts to 15% of your overall credit score.

Bottom line is, age matters. It counts the number of accounts that you have, how long you have had them under your name and the average age that your accounts have been active.

Your score will also be affected by how often you use certain accounts like your credit cards. If they show that you use it often and yet your balance is low, then that will reflect a high score. On the other hand, if you are not using your card much and yet you have a high balance, then that does not bode well for you.

How to Get Pre-Approved or Pre-Qualify for a Credit Card

A credit card can come in handy in many different ways. If you want to enjoy a life of maximum convenience, credit card approval can go a long way. It can give you access to a broad assortment of advantages as well. These include the opportunity to enhance your credit score, freedom to not carry around cash and large assortment of rewards possibilities.

It doesn’t matter if you like the idea of not having to have cash on hand at all times. It doesn’t matter if you want to be able to earn miles that can go toward upcoming air travel. Credit cards can be a source of pure convenience and ease for many. If you want to know how to get credit card pre-approval, there are various suggestions that can help you go on the right path. It isn’t impossible to get a credit card. It’s even often possible if you have bad credit, perhaps surprisingly enough.

Know That Application Moderation Is Key

Don’t make the mistake of filling out applications for excessive numbers of cards all at the same time. It’s critical to understand that the application process dings your score. People who try to sign up for multiple cards simultaneously, as a result, don’t leave potential lenders with positive first impressions.

Understand that time is your friend. There’s nothing wrong with taking things slowly but surely with the application process. Aim to split up your applications by a minimum of six months if at all possible.

Be Aware of the Information in Your Credit Reports

It’s vital to critically assess the information that’s in your credit reports prior to applying for any cards. If you’re in the loop, you can catch and manage possible mistakes. It can be a recipe for disaster to apply for a card prior to checking your report for possible issues and inconsistencies. You don’t want laziness to interfere with your chances of securing a helpful credit card, after all. If you analyze your credit report and pick up on any mistakes, you need to reach out to your credit reporting firm as soon as possible. Dispute filing can often quickly turn things around.

Be Responsible For Bill Payment

Responsibility is key for people who want to be able to secure the cards of their dreams. If you want potential lenders to be 100 percent aware of the fact that they can trust you, you need to prove to them that you’re responsible and dependable. Make a point to take care of all of your bills in a prompt and punctual manner. Steer clear of paying your bills late. You have to pay bills for your utilities, rent, mortgage, student loans and credit cards by their due dates, no exceptions. If you want to get pre-approved without hassle, you can’t be careless about your energy bills. You can’t be casual about anything bill-related for that matter.

Understand That There Are Cards That Are Appropriate For Your Specific Score Don’t waste your precious time. It can be a pointless to fill out applications for credit cards that cater to people that have scores that are either higher or lower than yours. If your credit score is just “so-so,” don’t try to sign up for a card that’s suitable for people who have exemplary ratings. Your chances of getting pre-approved are practically nonexistent. If you want to be wise and efficient, begin with cards that are appropriate for your score range.

STARTUP BUSINESS LOANS FICO 680+

Requirements: 6 Trade Lines with (Dun & Brad Street)

Get a Fast Business Loan Today!

from $5,000 to $300,000.00 with no collateral or business plan required & receive a no obligation decision.

Funding Custom Tailored to Your Business

Skynet offers the best small business loans available today. The process of simply walking into your bank for a loan doesn't always work, and in many cases, isn't even the best option. We remove the stress from trying to figure out which lender has the right type of loan for your situation. Our in-house underwriting team has over 25 years of experience in all areas of small business funding and we have direct relationships with our lenders. We intimately understand each lender's specific underwriting criteria which allows us to package and place your loan with speed and precision.

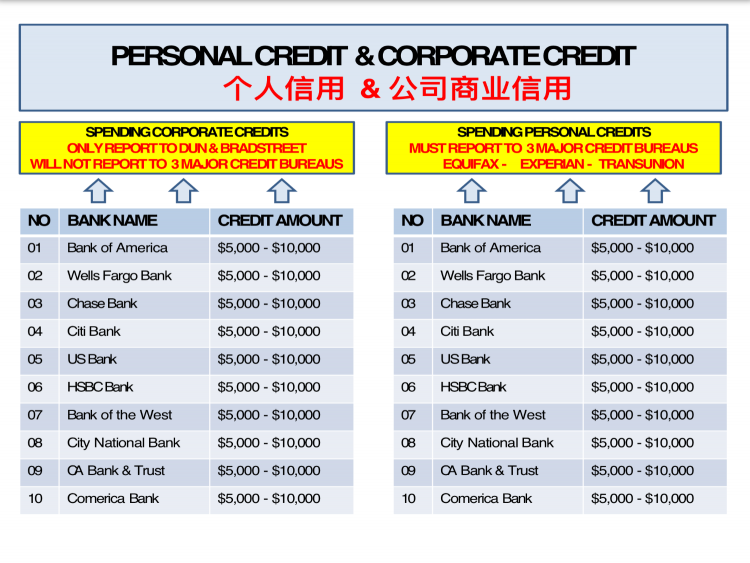

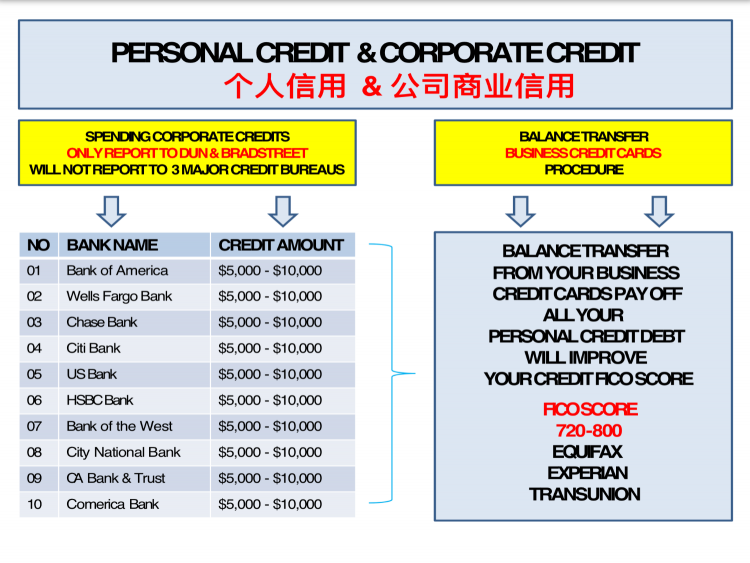

Credit Cards for Businesses

A small business credit card can be a good choice if you're looking to finance your business using revolving credit. Unlike traditional lines of credit, these cards give you the flexibility on monthly payments (minimum payments vs full balance vs something else). Some of these cards may also provide cash-back rewards on typical office purchases. Click on the images below to get specific advice on business credit cards from our experts.

Business credit cards exist so that cardholders can separate their business and personal expenses as well to offer additional features useful to business owners. For example, business credit cards may offer authorized credit cards for employees at no additional charge. These cards can include features such as alerts and spending limits to help business card owners keep track of employee use. In addition, business credit cards can offer other benefits for business owners such as airport lounge access and increased limits or purchase protection policies. Finally, if you are a business cardholder who pays your statement balances in full each month, then you should consider a card that will help you earn some rewards for your spending such as airline miles, hotel points or cash-back bonuses.

As a business credit card user, you should avoid paying for more credit card features and benefits than you will actually need. There are many business cards with annual fees of around $100, but most of these cards are designed to provide travel benefits to cardholders. Alternatively, there are business cards with little or no annual fee that are more ideally suited to business card users who don't travel often. In addition, many of these travel rewards business credit cards have higher interest rates than similar cards that do not offer rewards. Finally, if you are a business cardholder who is also a sole proprietor, then you should realize that each statement balance will be reported as personal debt to the major consumer credit bureaus, which is not the case for businesses that have been incorporated. Your credit card balances, even if paid in full every month, can affect your personal credit scores, so keep that in mind before opening a business credit card in your name if you're a sole proprietor.

There are some reasons why business owners may want more than one credit card, just like personal credit card users. For example, you may want to use different credit cards that offer different rewards and benefits such as airline and hotel rewards credit cards. In addition, some business credit cards will offer lower interest rates and promotional offers that can be more suited to times when companies need to carry a balance.

Business credit cards can allow you to separate your business and personal expenses while offering additional features needed most by business owners. A business credit card is still opened using the credit profile of the primary account holder, so you should apply for a business card with the same considerations you might use when applying for a personal credit card. For example, business owners should not apply for several cards all at once, or apply for a card right before you know you'll be applying for a larger loan like a mortgage. Finally, those incorporating a small business should wait until they have received an employee identification number from the IRS, while those operating as sole proprietors can use their Social Security numbers.

The time has come to expand your business with new employees, a larger location or a new product line. It’s an exciting time, but stressful because you’re not sure you have the cash reserves to manage the expansion.

For many small businesses, this situation calls for a small business loan: a cash infusion that pays for itself, plus the interest, with the new opportunities and extra income it allows you to create.

Many small business owners, however, are new to small business lending. Though they’re familiar with personal loans, they only know the basics of small business loans, working capital and lines of credit. For those who “resemble that remark” – and for more experienced folks who would like a review of how to get a small business loan – here is your list of the top five small business loan requirements to get the best possible small business loan.

1. STRONG CREDIT

The bad news about small business lending is it can be hard to qualify for the best rates and deals. The good news is this decade has more options for good small business loans than at any other time in history. You can choose between platform lending, traditional loans (like from a bank) and a variety of hybrid options available from local vendors or via the internet.

This flexibility doesn’t mean your company shouldn’t look as good as possible on paper. Your FICO credit score will figure heavily in any lending decision, so (if time permits) spend time grooming that number in the months prior to applying. Research what other metrics the lenders you want to use, and groom them as much as possible, too.

If you have a major ding in your credit, like a repossession or string of late payments, be prepared to discuss them and why things will go better in the future.

However, some lenders may look at more than just your credit score. If your credit score isn’t as strong as it could be, but you have a variety of other factors to help strengthen your business, include those as well. Some online lenders like to look at those to determine the overall health of your business – they know you’re more than just a number.

2. SOLID BUSINESS PLAN/GATHER DOCUMENTS

Part of understanding how to get a small business loan is ensuring you have a solid business loan. You should have one of these anyway since a strong business plan is a prerequisite for stellar business success. Traditional lenders will expect to see an updated, professionally prepared business plan as part of the lending process. Lacking one tells them you’re not ready for the “big leagues” and are a bad credit list.

Though some platform lenders won’t insist on seeing your formal business plan, similar documents about your social presence, industry statistics and unique market advantages – all of which are part of a comprehensive business plan – will go into decisions about what to lend you and how much it will cost.

Either way, get a business plan together and your documents. Those documents can include:

Personal and business income tax return

Personal and business bank statements

A photo/copy of your driver’s license

Commercial leases/Business licenses

Articles of incorporation

A resume that shows relevant management or business experience

Financial projections if you have a limited operating history

3. COMPELLING PERSONAL RÉSUMÉ

Traditional lenders want proof that the people responsible for running a business are qualified to do so, and part of that proof will be seeing the résumés for you and other principles like owners and executive officers. This résumé should be as solid, well-edited and up-to-date as any résumé you’ve ever sent out.

Consider: The purpose of a résumé is to get you the job you want. The purpose of this résumé is to get you the job of running the company you want, instead of the company you have.

Platform lenders don’t look at your traditional résumé, but they will look at your business’ curriculum vitae in terms of performance metrics and social sharing. Take time to groom those items as substantially as you would a regular résumé.

4. BULLETPROOFED P&L STATEMENTS

Like your business plan, you should have these anyway. You should be using your profit and loss statements as part of a robust monthly “vital signs” check for your business. If you’re not doing them, dig into your accounting software for half an hour. You’ll find a tool that compiles P&Ls from your records. If you’re not using software to keep track of your financials, get started on doing that.

Lenders of all stripes are looking for three things in your P&L: reliability, professionalism, and ethicality. We’ll break them down:

Reliability – They want evidence that you will be able to make your promised payments, based on enough cash flow to cover the loan. If you don’t, the lender will assume that lending you money is too high a risk.

Professionalism – Lenders presented with incomplete, inaccurate or hastily prepared P&L statements will assume that your business is similarly disorganized.

Ethicality – If you “fudge” your numbers to look better and get caught, you are done with that lender. The decision makers will assume that you cut ethical corners in other places.

5. KNOWLEDGE OF THE LOAN NEEDED

This is actually the first of the small business requirements that you should address, but we wanted to mention it last so it would be the freshest in your mind. Lending isn’t what it used to be – a situation where you went to a couple of banks, all of which offered the same basic products, and hoped they would agree to give you a loan.

Modern small business lending includes a wide array of traditional, platform and peer-to-peer options with wildly varying qualification requirements and rates of interest. Before you start working in earnest on the other four requirements for your loan, decide what type of loan best fits your business. That way you won’t waste time and effort preparing the wrong documents.

Small business loan applications are becoming more simple and streamlined, enabling small business owners to access the funding they need. Dig into your research, find your best fit.

Requirements: 6 Trade Lines with (Dun & Brad Street)

Get a Fast Business Loan Today!

from $5,000 to $300,000.00 with no collateral or business plan required & receive a no obligation decision.

Funding Custom Tailored to Your Business

Skynet offers the best small business loans available today. The process of simply walking into your bank for a loan doesn't always work, and in many cases, isn't even the best option. We remove the stress from trying to figure out which lender has the right type of loan for your situation. Our in-house underwriting team has over 25 years of experience in all areas of small business funding and we have direct relationships with our lenders. We intimately understand each lender's specific underwriting criteria which allows us to package and place your loan with speed and precision.

Credit Cards for Businesses

A small business credit card can be a good choice if you're looking to finance your business using revolving credit. Unlike traditional lines of credit, these cards give you the flexibility on monthly payments (minimum payments vs full balance vs something else). Some of these cards may also provide cash-back rewards on typical office purchases. Click on the images below to get specific advice on business credit cards from our experts.

Business credit cards exist so that cardholders can separate their business and personal expenses as well to offer additional features useful to business owners. For example, business credit cards may offer authorized credit cards for employees at no additional charge. These cards can include features such as alerts and spending limits to help business card owners keep track of employee use. In addition, business credit cards can offer other benefits for business owners such as airport lounge access and increased limits or purchase protection policies. Finally, if you are a business cardholder who pays your statement balances in full each month, then you should consider a card that will help you earn some rewards for your spending such as airline miles, hotel points or cash-back bonuses.

As a business credit card user, you should avoid paying for more credit card features and benefits than you will actually need. There are many business cards with annual fees of around $100, but most of these cards are designed to provide travel benefits to cardholders. Alternatively, there are business cards with little or no annual fee that are more ideally suited to business card users who don't travel often. In addition, many of these travel rewards business credit cards have higher interest rates than similar cards that do not offer rewards. Finally, if you are a business cardholder who is also a sole proprietor, then you should realize that each statement balance will be reported as personal debt to the major consumer credit bureaus, which is not the case for businesses that have been incorporated. Your credit card balances, even if paid in full every month, can affect your personal credit scores, so keep that in mind before opening a business credit card in your name if you're a sole proprietor.

There are some reasons why business owners may want more than one credit card, just like personal credit card users. For example, you may want to use different credit cards that offer different rewards and benefits such as airline and hotel rewards credit cards. In addition, some business credit cards will offer lower interest rates and promotional offers that can be more suited to times when companies need to carry a balance.

Business credit cards can allow you to separate your business and personal expenses while offering additional features needed most by business owners. A business credit card is still opened using the credit profile of the primary account holder, so you should apply for a business card with the same considerations you might use when applying for a personal credit card. For example, business owners should not apply for several cards all at once, or apply for a card right before you know you'll be applying for a larger loan like a mortgage. Finally, those incorporating a small business should wait until they have received an employee identification number from the IRS, while those operating as sole proprietors can use their Social Security numbers.

The time has come to expand your business with new employees, a larger location or a new product line. It’s an exciting time, but stressful because you’re not sure you have the cash reserves to manage the expansion.

For many small businesses, this situation calls for a small business loan: a cash infusion that pays for itself, plus the interest, with the new opportunities and extra income it allows you to create.

Many small business owners, however, are new to small business lending. Though they’re familiar with personal loans, they only know the basics of small business loans, working capital and lines of credit. For those who “resemble that remark” – and for more experienced folks who would like a review of how to get a small business loan – here is your list of the top five small business loan requirements to get the best possible small business loan.

1. STRONG CREDIT

The bad news about small business lending is it can be hard to qualify for the best rates and deals. The good news is this decade has more options for good small business loans than at any other time in history. You can choose between platform lending, traditional loans (like from a bank) and a variety of hybrid options available from local vendors or via the internet.

This flexibility doesn’t mean your company shouldn’t look as good as possible on paper. Your FICO credit score will figure heavily in any lending decision, so (if time permits) spend time grooming that number in the months prior to applying. Research what other metrics the lenders you want to use, and groom them as much as possible, too.

If you have a major ding in your credit, like a repossession or string of late payments, be prepared to discuss them and why things will go better in the future.

However, some lenders may look at more than just your credit score. If your credit score isn’t as strong as it could be, but you have a variety of other factors to help strengthen your business, include those as well. Some online lenders like to look at those to determine the overall health of your business – they know you’re more than just a number.

2. SOLID BUSINESS PLAN/GATHER DOCUMENTS

Part of understanding how to get a small business loan is ensuring you have a solid business loan. You should have one of these anyway since a strong business plan is a prerequisite for stellar business success. Traditional lenders will expect to see an updated, professionally prepared business plan as part of the lending process. Lacking one tells them you’re not ready for the “big leagues” and are a bad credit list.

Though some platform lenders won’t insist on seeing your formal business plan, similar documents about your social presence, industry statistics and unique market advantages – all of which are part of a comprehensive business plan – will go into decisions about what to lend you and how much it will cost.

Either way, get a business plan together and your documents. Those documents can include:

Personal and business income tax return

Personal and business bank statements

A photo/copy of your driver’s license

Commercial leases/Business licenses

Articles of incorporation

A resume that shows relevant management or business experience

Financial projections if you have a limited operating history

3. COMPELLING PERSONAL RÉSUMÉ

Traditional lenders want proof that the people responsible for running a business are qualified to do so, and part of that proof will be seeing the résumés for you and other principles like owners and executive officers. This résumé should be as solid, well-edited and up-to-date as any résumé you’ve ever sent out.

Consider: The purpose of a résumé is to get you the job you want. The purpose of this résumé is to get you the job of running the company you want, instead of the company you have.

Platform lenders don’t look at your traditional résumé, but they will look at your business’ curriculum vitae in terms of performance metrics and social sharing. Take time to groom those items as substantially as you would a regular résumé.

4. BULLETPROOFED P&L STATEMENTS

Like your business plan, you should have these anyway. You should be using your profit and loss statements as part of a robust monthly “vital signs” check for your business. If you’re not doing them, dig into your accounting software for half an hour. You’ll find a tool that compiles P&Ls from your records. If you’re not using software to keep track of your financials, get started on doing that.

Lenders of all stripes are looking for three things in your P&L: reliability, professionalism, and ethicality. We’ll break them down:

Reliability – They want evidence that you will be able to make your promised payments, based on enough cash flow to cover the loan. If you don’t, the lender will assume that lending you money is too high a risk.

Professionalism – Lenders presented with incomplete, inaccurate or hastily prepared P&L statements will assume that your business is similarly disorganized.

Ethicality – If you “fudge” your numbers to look better and get caught, you are done with that lender. The decision makers will assume that you cut ethical corners in other places.

5. KNOWLEDGE OF THE LOAN NEEDED

This is actually the first of the small business requirements that you should address, but we wanted to mention it last so it would be the freshest in your mind. Lending isn’t what it used to be – a situation where you went to a couple of banks, all of which offered the same basic products, and hoped they would agree to give you a loan.

Modern small business lending includes a wide array of traditional, platform and peer-to-peer options with wildly varying qualification requirements and rates of interest. Before you start working in earnest on the other four requirements for your loan, decide what type of loan best fits your business. That way you won’t waste time and effort preparing the wrong documents.

Small business loan applications are becoming more simple and streamlined, enabling small business owners to access the funding they need. Dig into your research, find your best fit.

银行现金周转

免费修复个人信用

如果您私人的信用分数在680分以上,

我们能帮您申请私人信用卡跟公司的信用现金周转

DISCLAIMER

Skynet USA Asset Management, Inc. is an independent review service and directory. The content presented may not be provided or commissioned by any credit issuer. Opinions expressed here are the author’s alone, not those of any credit issuer or company, and have not been reviewed, approved or otherwise endorsed by any credit issuer or company reviewed. Skynet USA Asset Management,Inc. Web site are provided “as is”. Skynet USA Asset Management, Inc. makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Skynet USA Asset Management, Inc. does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

Skynet USA Asset Management, Inc. is an independent review service and directory. The content presented may not be provided or commissioned by any credit issuer. Opinions expressed here are the author’s alone, not those of any credit issuer or company, and have not been reviewed, approved or otherwise endorsed by any credit issuer or company reviewed. Skynet USA Asset Management,Inc. Web site are provided “as is”. Skynet USA Asset Management, Inc. makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Skynet USA Asset Management, Inc. does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

VIDEO-VENDOR CREDIT THE SECRET INGREDIENT FOR ANY BUSINESS TO START

Skynet USA Asset Management & Consulting, Inc. 1.702.969.5599 Email. johnnyhong1963@gmail.com

JOHNNY HONG

洪 成

1.702.969.5599

1.714.512.2393

洪 成

1.702.969.5599

1.714.512.2393

PERSONAL FICO SCORE 680+

PERSONAL FICO SCORE 680+

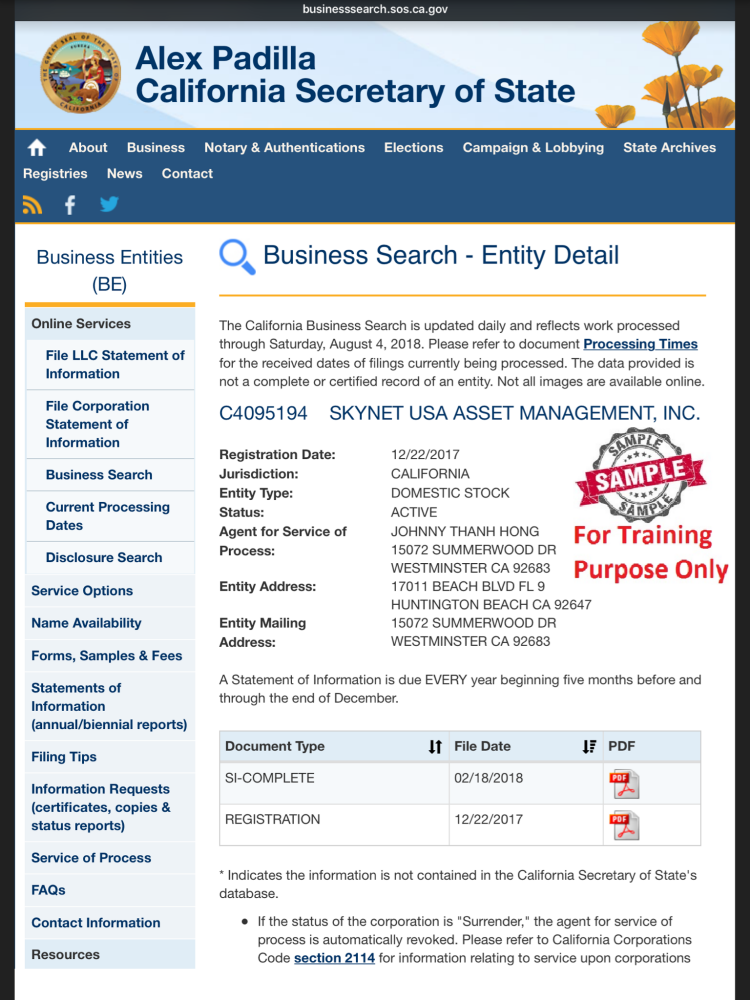

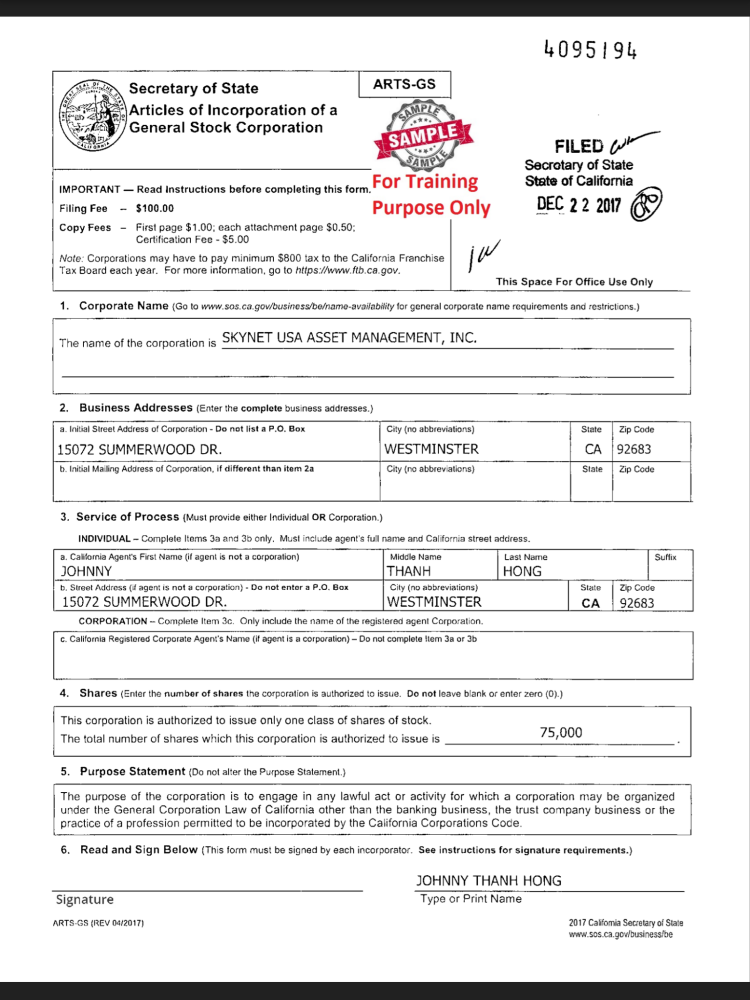

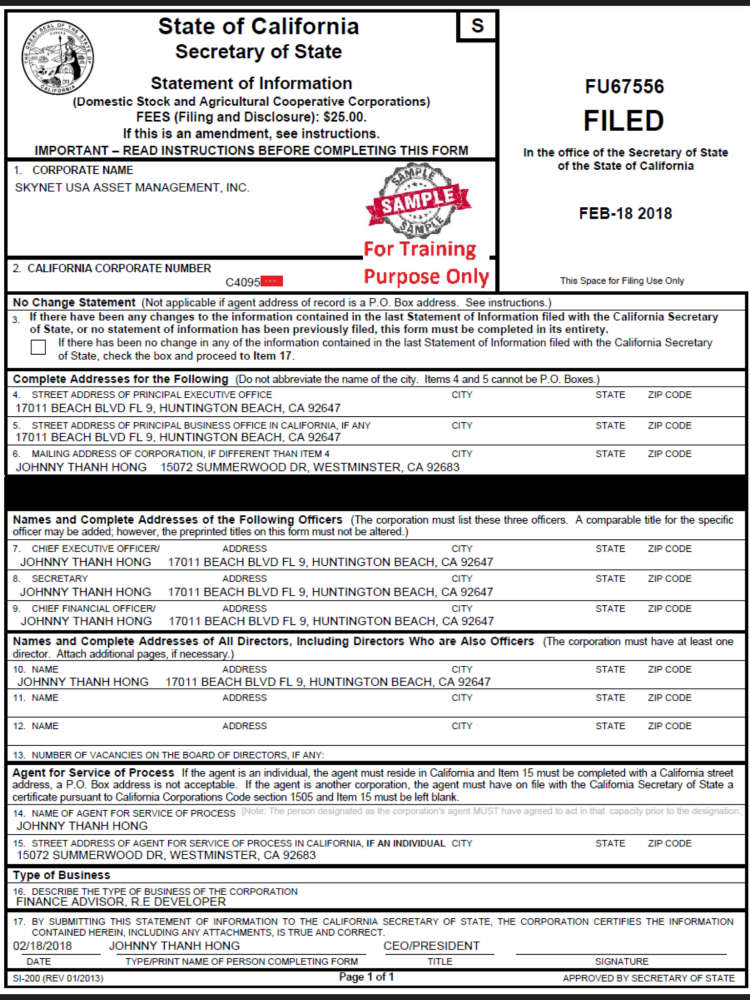

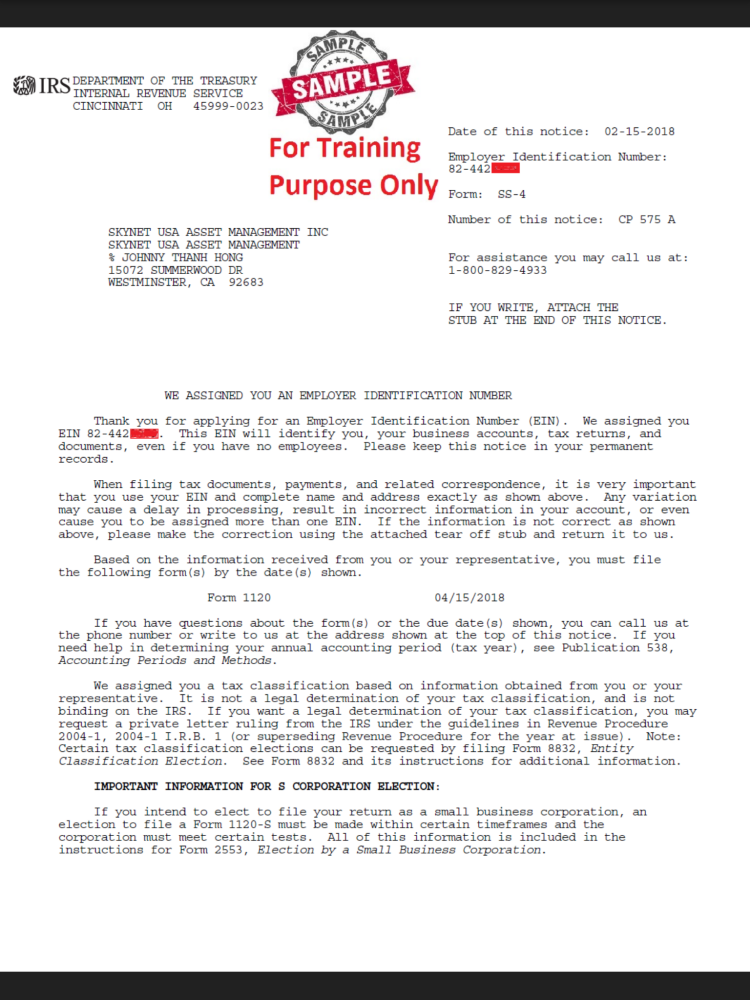

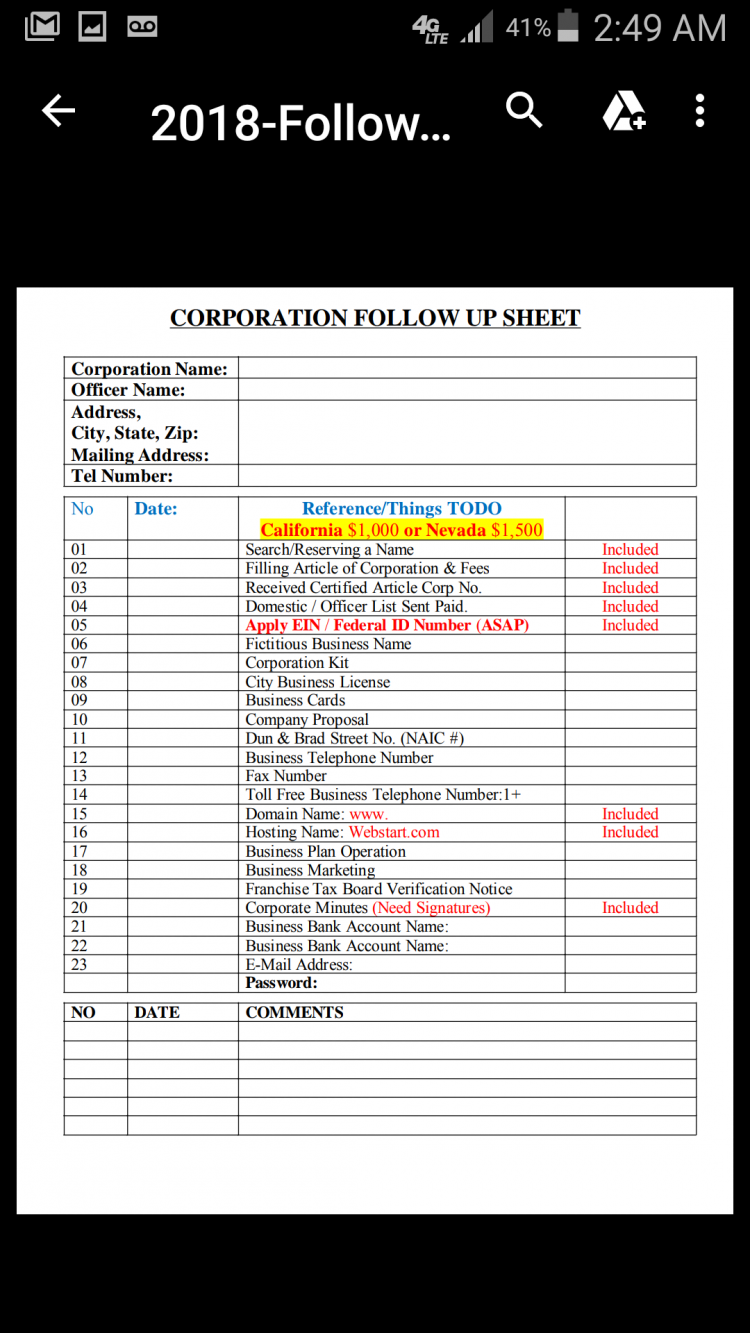

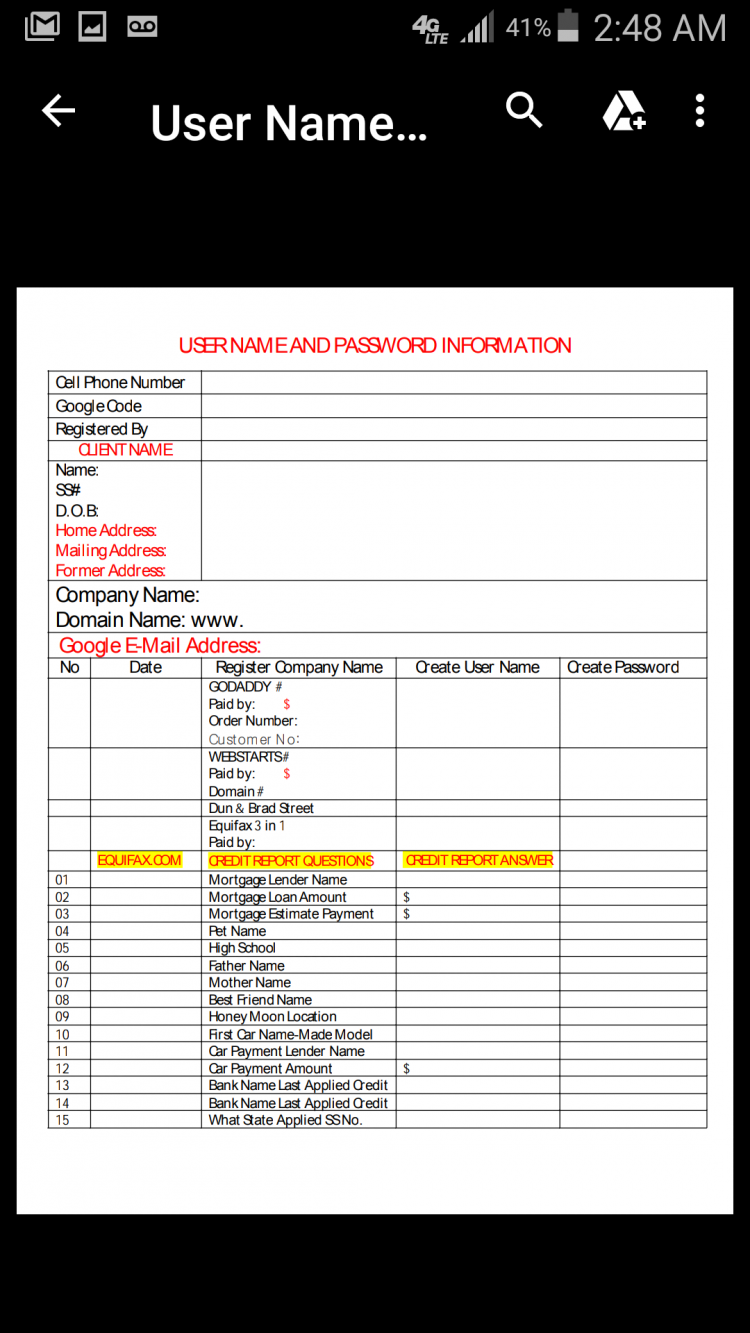

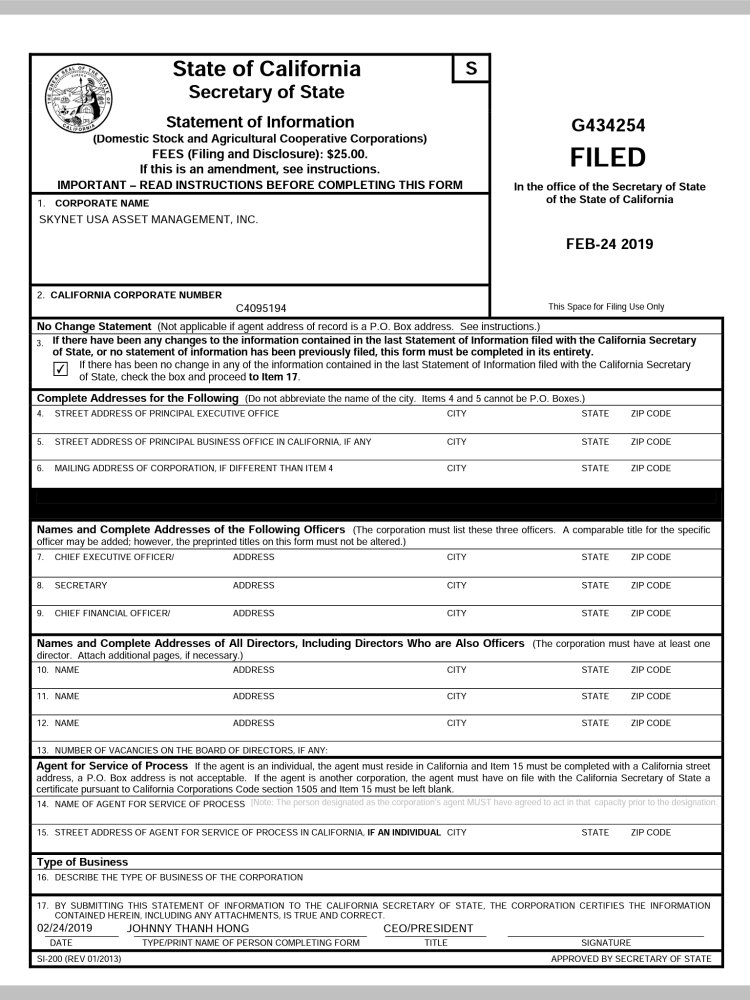

CORPORATION SAMPLE FORMS USE FOR

TRAINING PURPOSE ONLY

VIDEO

16:56 Minutes

16:56 Minutes

APPROVED

现金周转

免费维修个人信用

如果您私人的信用分数在680分以上,

我们能帮您申请私人信用卡跟公司的信用现金周转

免费维修个人信用

如果您私人的信用分数在680分以上,

我们能帮您申请私人信用卡跟公司的信用现金周转

$$$

$$$

银

行

现

金

周

转

行

现

金

周

转

银

行

现

金

周

转

行

现

金

周

转

BANK CASH ADVANCE