Skynet USA Asset Management, Inc. | 702.969.5599 | Email: johnnyhong1962@gmail.com

WELCOME TO SKYNET USA ASSET MANAGEMENT, INC.

BUSINESS ACQUISITION DIVISION INVEST IN PRIVATE TECH COMPANIES BEFORE THEY IPO

WE BUY/SELL EXISTING PUBLIC COMPANIES/BUSINESS ACQUISITION

现金周转

需要现金私人投资

1. 投资: 香港银行项目 赚大钱的机会

2. 投资: 银行拍卖的房子

3. 投资: 收购将要上市的股票公司

现金周转

需要现金私人投资

1. 投资: 香港银行项目 赚大钱的机会

2. 投资: 银行拍卖的房子

3. 投资: 收购将要上市的股票公司

JOHNNY HONG

洪 春 成

Founder/CEO

SKYNET USA ASSET MANAGEMENT, INC.

Email: johnnyhong1962@gmail.com

Contact No.702.969.5599

洪 春 成

Founder/CEO

SKYNET USA ASSET MANAGEMENT, INC.

Email: johnnyhong1962@gmail.com

Contact No.702.969.5599

CONTACT INFORMATION

TELEPHONE- SMS- SKYPE- VIBER- WECHAT

U. S. Cell No. 702.969.5599

Skype Name: Johnnyhong70

Viber: 702.969.5599

Wechat: Johnny Hong 1963

Wechat ID: JOHNNY-HONG-USA

sww.skynetusacorporation.com

Email Adress: johnnyhong1962@gmail.com

TELEPHONE- SMS- SKYPE- VIBER- WECHAT

U. S. Cell No. 702.969.5599

Skype Name: Johnnyhong70

Viber: 702.969.5599

Wechat: Johnny Hong 1963

Wechat ID: JOHNNY-HONG-USA

sww.skynetusacorporation.com

Email Adress: johnnyhong1962@gmail.com

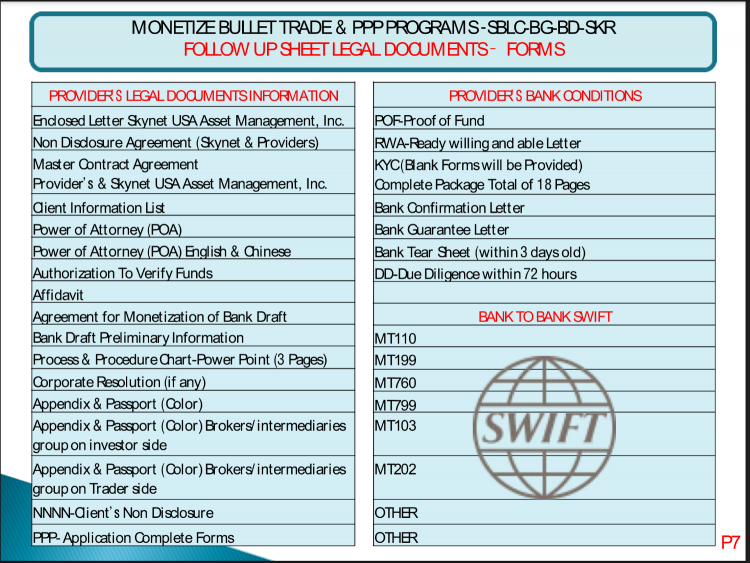

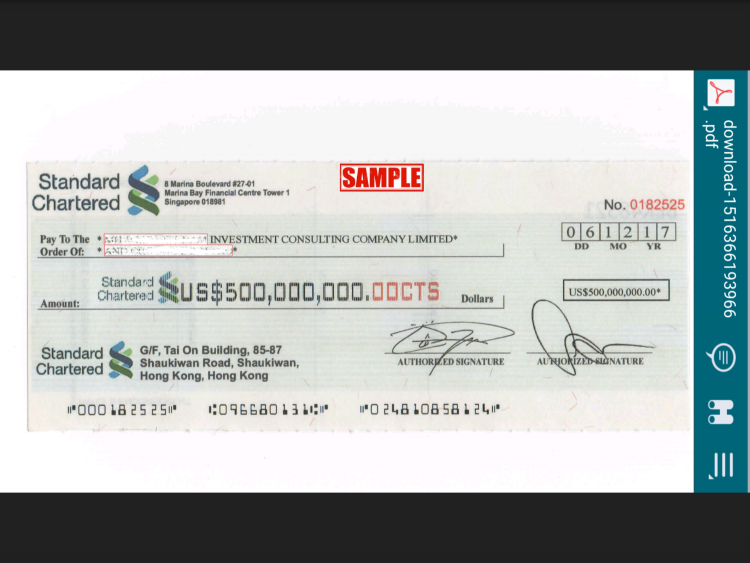

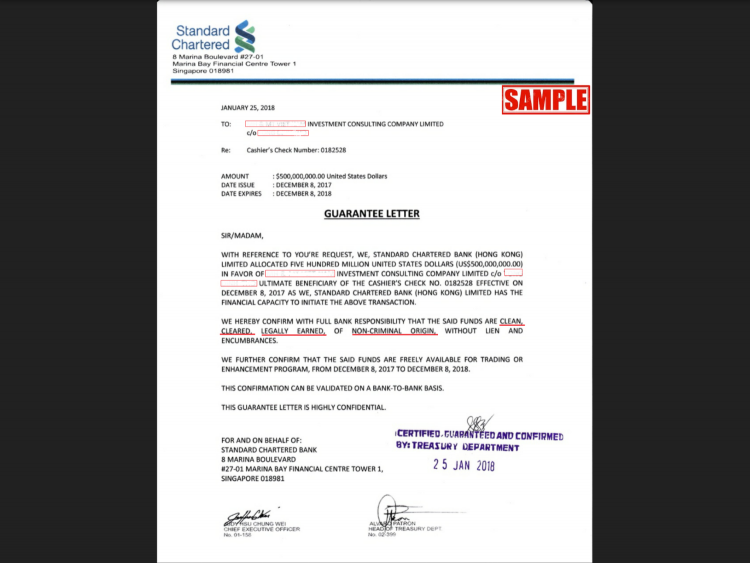

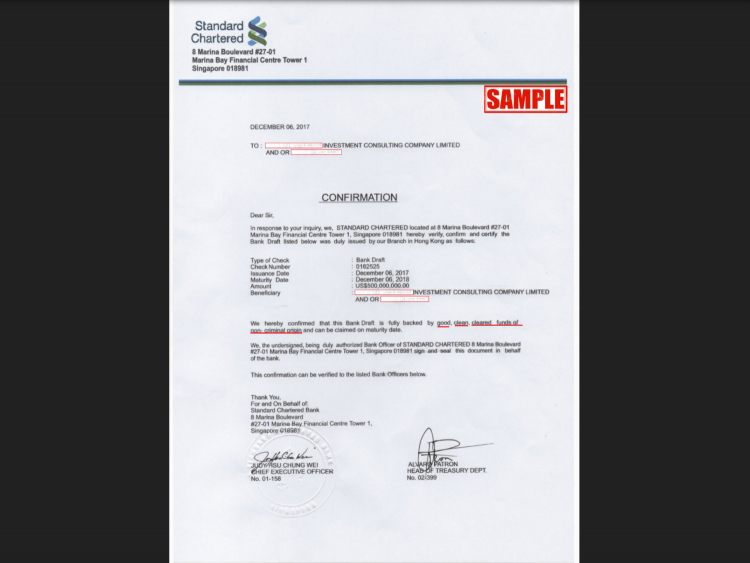

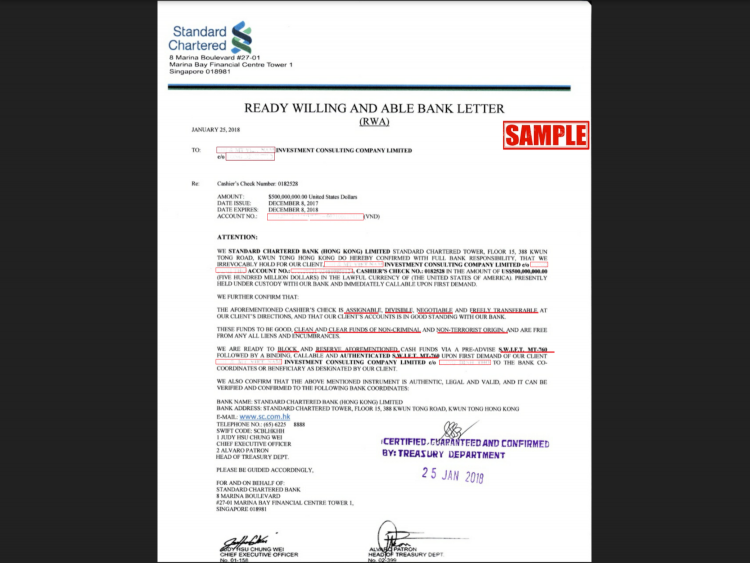

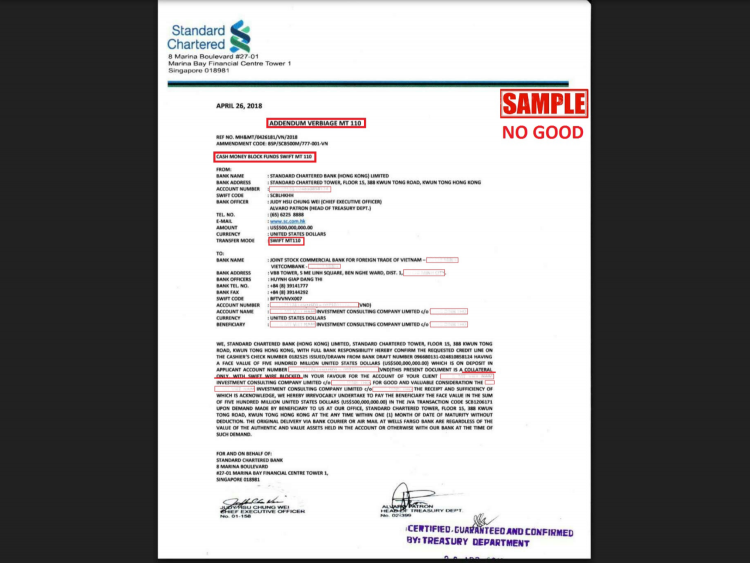

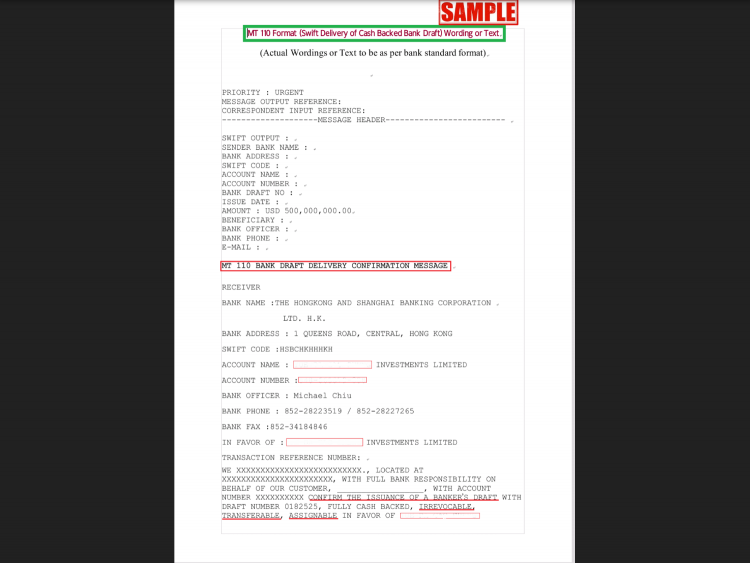

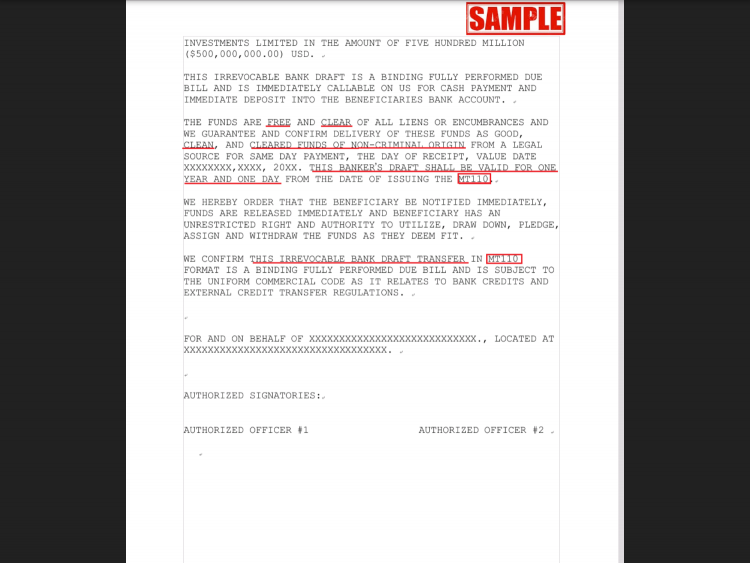

THIS BANK DRAFT & BANK LETTERS LEGAL DOCUMENTS PRESENTATION FOR TRAINING PURPOSE ONLY

THIS PRESENTATION USE

FOR TRAINING PURPOSE ONLY

SKYNET USA ASSET MANAGEMENT, INC.

Preferred Industries

• Aerospace and Defense

• Business to business services

• Chemical manufacturing

• Commercial manufacturing and distribution

• Consumer products, including branded and private labels

• Energy service

• Healthcare service and medical devices manufacturing

• Industry equipment manufacturing

• Industrial equipment manufacturing

• Information technology (products and services)

• Logistics and transportation

• Security Infrastructure manufacturing and services

In general, Skynet USA Asset Management, Inc. does not invest in or acquire businesses where sales are limited to the company’s local geographic area such as restaurants and retail stores. However, some local service companies may be of interest depending on whether the business model is unique and can be replicated successfully at other locations, or if synergies can be realized from the acquisition and integration of similar businesses.

Overview

BUSINESS ACQUISITION DIVISION

WE BUY/SELL EXISTING PUBLIC COMPANIES/BUSINESS ACQUISITION!

WE BUY/SELL EXISTING PUBLIC COMPANIES/BUSINESS ACQUISITION!

Investment Criteria

Skynet USA Asset Management, Inc. seeks stable companies in non-commodity manufacturing, distribution, and business-to-businesses services. Leverage will be used within conservative limits to finance acquisitions. The firm may also co-invest as part of a syndicate in larger transactions that meet its investment criteria.

The firm will acquire profitable companies with revenue between $10 to $200 million and EBITDA of at least $1 million and reflecting an appropriate margin for the industry. Acquisitions must also meet the following criteria:

Skynet USA Asset Management, Inc. seeks stable companies in non-commodity manufacturing, distribution, and business-to-businesses services. Leverage will be used within conservative limits to finance acquisitions. The firm may also co-invest as part of a syndicate in larger transactions that meet its investment criteria.

The firm will acquire profitable companies with revenue between $10 to $200 million and EBITDA of at least $1 million and reflecting an appropriate margin for the industry. Acquisitions must also meet the following criteria:

Investment Criteria

• Consistent positive cash flow during at least the past five years with EBITDA exceeding $1 million • Mature, stable industry; business not reliant on new technology

• Fragmented competitive and customer markets, with consistent (relatively non-cyclical) demand for the industry’s products

• Opportunities for financial improvement (e.g., manufacturing or labor productivity enhancement, market expansion, scale efficiencies through add-on acquisitions, etc.)

• Consistent positive cash flow during at least the past five years with EBITDA exceeding $1 million • Mature, stable industry; business not reliant on new technology

• Fragmented competitive and customer markets, with consistent (relatively non-cyclical) demand for the industry’s products

• Opportunities for financial improvement (e.g., manufacturing or labor productivity enhancement, market expansion, scale efficiencies through add-on acquisitions, etc.)

• Diversified customer base; sales not highly dependent on one or a few customers

• Diversified supplier base

• No foreseen developments that could adversely impact the company’s performance (e.g., demographic changes, technology shifts)

• Diversified supplier base

• No foreseen developments that could adversely impact the company’s performance (e.g., demographic changes, technology shifts)

• Access to knowledgeable and capable management

• Proprietary edge over competition

• Meets lender or institutional criteria for debt financing

• Profitable exit opportunities Acquisition multiple appropriate for size, industry, growth rate and risk profile

• Revenue between $5 and $150 million

• In business of providing same or similar products / services for at least past five years

• Positive cash flow for each of past three years

• Employee turnover equal to or lower than the industry standard

• Opportunities for growth (e.g., geographic expansion, product / service enhancement, outsourcing / offshoring, etc.)

• Proprietary edge over competition

• Meets lender or institutional criteria for debt financing

• Profitable exit opportunities Acquisition multiple appropriate for size, industry, growth rate and risk profile

• Revenue between $5 and $150 million

• In business of providing same or similar products / services for at least past five years

• Positive cash flow for each of past three years

• Employee turnover equal to or lower than the industry standard

• Opportunities for growth (e.g., geographic expansion, product / service enhancement, outsourcing / offshoring, etc.)

• Experienced and knowledgeable management willing to stay for at least two years post transaction

• Defensible market position

Ideal target companies are those that, while already profitable, can benefit from a renewed emphasis on operating efficiency, sales aggressiveness and, in certain cases, the application of IT or other established technology.

• Defensible market position

Ideal target companies are those that, while already profitable, can benefit from a renewed emphasis on operating efficiency, sales aggressiveness and, in certain cases, the application of IT or other established technology.

Preferred Industries

• Aerospace and Defense

• Business to business services

• Chemical manufacturing

• Commercial manufacturing and distribution

• Consumer products, including branded and private labels

• Energy service

• Healthcare service and medical devices manufacturing

• Industry equipment manufacturing

• Industrial equipment manufacturing

• Information technology (products and services)

• Logistics and transportation

• Security Infrastructure manufacturing and services

In general, Skynet USA Asset Management, Inc. does not invest in or acquire businesses where sales are limited to the company’s local geographic area such as restaurants and retail stores. However, some local service companies may be of interest depending on whether the business model is unique and can be replicated successfully at other locations, or if synergies can be realized from the acquisition and integration of similar businesses.

Overview

Skynet USA Asset Management, Inc. is a private equity investment group that invests in and acquires privately-owned companies in North America. Our investments are made in traditional economy manufacturing, distribution and service businesses with revenue between $10 and $200 million. We also actively pursue information technology companies (hardware, software, internet and IT services).Post-acquisition, we provide management teams with the capital and relationships that enable expansion into new product lines and markets and profitably grow the business. The firm, collectively with its investors and advisors, benefits from deep experience in business operations, market entry and growth strategy development, and private company investing. Aleutian’s principals come from a complementary mix of operating, legal, management consulting and finance backgrounds.

Skynet USA Asset Management, Inc. is differentiated among private equity firms by its long-term investing perspective. While other firms typically seek to exit investments in two to six years, Aleutian is building a portfolio of companies it intends to hold and grow over an extended period.

We believe that smaller companies in fragmented, mature industries have a tremendous opportunity for double-digit growth if armed with the right combination of product planning, market aggressiveness, strategic partnerships, financial resources, operational excellence and a motivated employee base. Skynet USA Asset Management, Inc. helps bring these pieces together.

Skynet USA Asset Management, Inc. is a private equity investment group that invests in and acquires privately-owned companies in North America. Our investments are made in traditional economy manufacturing, distribution and service businesses with revenue between $10 and $200 million. We also actively pursue information technology companies (hardware, software, internet and IT services).Post-acquisition, we provide management teams with the capital and relationships that enable expansion into new product lines and markets and profitably grow the business. The firm, collectively with its investors and advisors, benefits from deep experience in business operations, market entry and growth strategy development, and private company investing. Aleutian’s principals come from a complementary mix of operating, legal, management consulting and finance backgrounds.

Skynet USA Asset Management, Inc. is differentiated among private equity firms by its long-term investing perspective. While other firms typically seek to exit investments in two to six years, Aleutian is building a portfolio of companies it intends to hold and grow over an extended period.

We believe that smaller companies in fragmented, mature industries have a tremendous opportunity for double-digit growth if armed with the right combination of product planning, market aggressiveness, strategic partnerships, financial resources, operational excellence and a motivated employee base. Skynet USA Asset Management, Inc. helps bring these pieces together.

SKYNET USA ASSET MANAGEMENT, INC. BUSINESS ACQUISITION DIVISION

DISCLAIMER:

DISCLAIMER:

Investments in private placements holding pre-IPO companies are speculative, illiquid, and carry a high degree of risk, including loss of principal. Investments made on the Skynet USA Asset Management, Inc. platform are made through pooled investment vehicles, which acquire shares of private technology companies, and are not direct investments in these companies.

Skynet USA Asset Management, Inc. is not a United States Securities Dealer or Broker or United States Investment Adviser, We are Independent Consultants and are not affiliated to any other company nor are employed by any other company.

Skynet USA Asset Management, Inc. is not a United States Securities Dealer or Broker or United States Investment Adviser, We are Independent Consultants and are not affiliated to any other company nor are employed by any other company.

Our services are intended to be used exclusively by Corporate and Institutional Clients or Accredited, Sophisticated Individual Investors in need of Advanced Consulting Services and Financial Solutions.

If you do not understand these of transactions, please do not call us. Thank You!

If you do not understand these of transactions, please do not call us. Thank You!